HDB Plus Flats: Changes to Housing Classification And How It Will Affect You

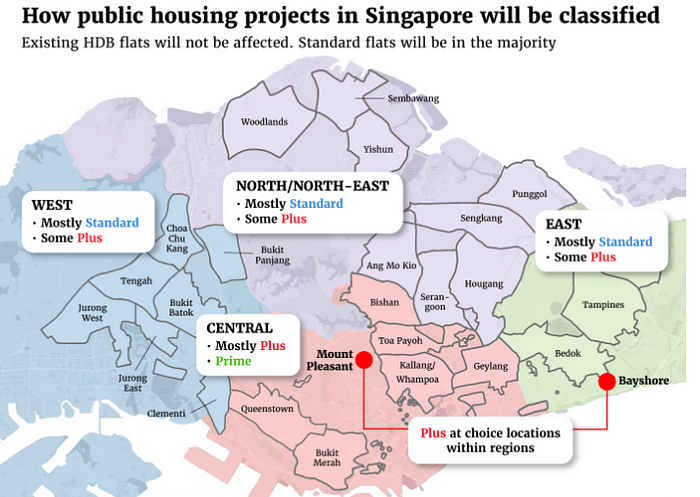

On 20 August, Singapore’s Prime Minister Lee Hsien Loong announced at the National Day Rally that there will be a new classification of HDB flats, to prime, plus and standard. This will replace the old system of mature versus non-mature estates which have been around for the past three decades.

In 1992, the classification of estates into mature and non-mature was to grant priority to first-time buyers and individuals who were unsuccessful in their flat application

In Nov 2021, Prime Location Public Housing (PLH) model was launched for public housing in prime locations to remain affordable, accessible and inclusive for all Singaporeans. So far, there has been 12 BTO projects launched under the PLH model. The aim of this was to reduce the lottery effect of obtaining a flat that could potentially achieve a million-dollar price tag upon obtaining its MOP status.

In Budget 2023, Deputy Prime Minister and Finance Minister Lawrence Wong announced an added ballot chance for first-timer families in non-mature estates if their initial two applications (also in non-mature estates) were unsuccessful.

We have also witnessed an increasing number of million-dollar flats being transacted. Shockingly, they are not limited to mature estates. This could be partly due to the pandemic which resulted in a supply gap, encouraging buyers to turn to the resale market. Furthermore, with work-from-home becoming a norm, space was a major consideration for many.

With these in mind, the differentiation between mature and non-mature estates became blurred. Personally, I feel that the new classification is a smart and fair way of classifying flats. It will definitely promote a more sustainable increment of public housing which aims to provide families with a roof at affordable prices. Without further ado, let us understand how this new classification will impact the housing market (both public and private) as a whole.

Address the BTO Lottery Effect

Flats under the PLH model came with a longer Minimum Occupation period (MOP) and subsidy clawback when sold to a resale buyer. This ensured that supply is left for those who really saw it as a home rather than as an investment tool. Furthermore, the longer MOP coupled with construction time will most likely discourage HDB upgraders from purchasing a flat within a prime location for the purpose of ‘flipping’.

Intuitively, there should be some adjustments in premium that sellers charge unto buyers since there is a shorter remaining lease. However, it is also worthy to note that we have yet to assess the effectiveness of a longer MOP since it will not be for another 15 years before the first batch of flats under the PLH model enters the resale market. Additionally, with a longer MOP, there may be a supply glut for newer resale flats in prime and plus locations. This could potentially result in higher resale prices for such flats given the quantity available.

Nonetheless, the take-up rate for flats under the PLH model has been effectively managed which is a good indication that flat supply in prime areas is kept for those who are buying primarily for home-staying. Whether prices will be adequately suppressed is a question for another time.

More Options for Singles Looking to Purchase a New Flat

Under the current public housing framework, singles aged 35 and older can only buy two-room flexi flats from the government in non-mature estates. With the new framework in mind, singles aged 35 and older can now consider two-room flexi flats across all BTO projects. Singles with pressing housing needs or prefer bigger flats (3-room to 5-room) are also not restricted to purchase from the resale market. However, an income ceiling of $14,000 will apply to singles buying Plus flats from the resale market in future.

This is joyous news for singles as they can now look forward to owning a subsidised flat from the government in locations that are of significant importance to them.

Implications on the HDB Resale Market

Since the subsidy clawback and longer MOP do not apply to existing flats in ‘better’ locations, we can expect the demand for flats in such locations to increase in the short-term.

In the long-run, we can definitely expect resale flat prices to moderate and increase at a sustainable pace. After all, that is the whole point of implementing a new classification for public housing in Singapore.

Overall, the new HDB policies addresses both accessibility, with more subsidies, and affordability, by imposing resale eligibility conditions to deter speculative activity.

Implications on the Private Market

The number of million-dollar HDB resale transaction rose 42.9% from 259 units in 2021 to 370 units in 2022. These cash-rich HDB upgraders can find themselves a decently-sized private home in the Outside Central Region (OCR) without really tapping into their savings. Driven by high demand in the OCR, the median price of new OCR launches set a new $2,000 psf benchmark, thereby closing the price gap of properties in the Core Central Region (CCR) and Rest of Central Region (RCR).

In the short-run, we can expect demand for private homes to increase as households nearing the $14,000 income threshold will consider private properties as an investment tool over public housing.

Safe to say, today’s inflated private home prices, especially in the OCR, is partly due to the stronger purchasing power of HDB upgraders. With income ceilings imposed on resale buyers of plus and prime HDB flats under the new ruling, couples with a combined income exceeding $14,000 will be ineligible. Over the long run, constrained demand will translate into softening resale prices, with a corresponding dip in the purchasing power of HDB upgraders. Eventually, prices of private homes may moderate as a result of lower buying capacity from this segment.

Conclusion

The Government’s priority for public housing has and will always stand from the point of availability and affordability. This is achieved via a two-pronged approach that involves discounting new BTO flats, and applying fiscal policy in the form of means-tested grants to subsidise the cost of purchase.

However, to keep up to speed with the evolving urban landscape, the call for a re-classification is a justified and timely measure by the Government. While there may be certain aspects, such as the 10-year MOP — which may pose future problems, at a macro level, we can expect prices to moderate amid higher housing accessibility and affordability.

I hope this article serves purposeful in helping you make a more well-informed decision, regardless of whether you’re purchasing a property for own-stay or investment. As always, feel free to share your opinion in the comment section and I will take time to address them when I can. Till next time!